Debt Service from WebMoney Transfer allows users to lend funds to other users (contacts) from their purses, on defined terms for a defined length of time.

Key terms

TRUST LIMIT - Established by a contact's offer, this limit is the total amount of title units that the User can receive under the Loan Agreement. This amount depends on the amount of title units in the contact's purse, taking into account Agreements that have already been signed but not performed.

TRUST LEVEL - This level is calculated for every user of WebMoney Transfer, based on all TRUST LIMITS, that have been opened for that user by other system users. The TRUST LEVEL increases for users with:

- more funds available under existing TRUST LIMITS;

- longer payback terms;

- more contacts who have opened a TRUST LIMIT for the user.

How to open a TRUST LIMIT

You can open a TRUST LIMIT for any user of WebMoney Transfer whom you have added to your contact list.

To access the form for creating a new TRUST LIMIT, in the «Contact properties» dialog, click the «Debt Service» tab.

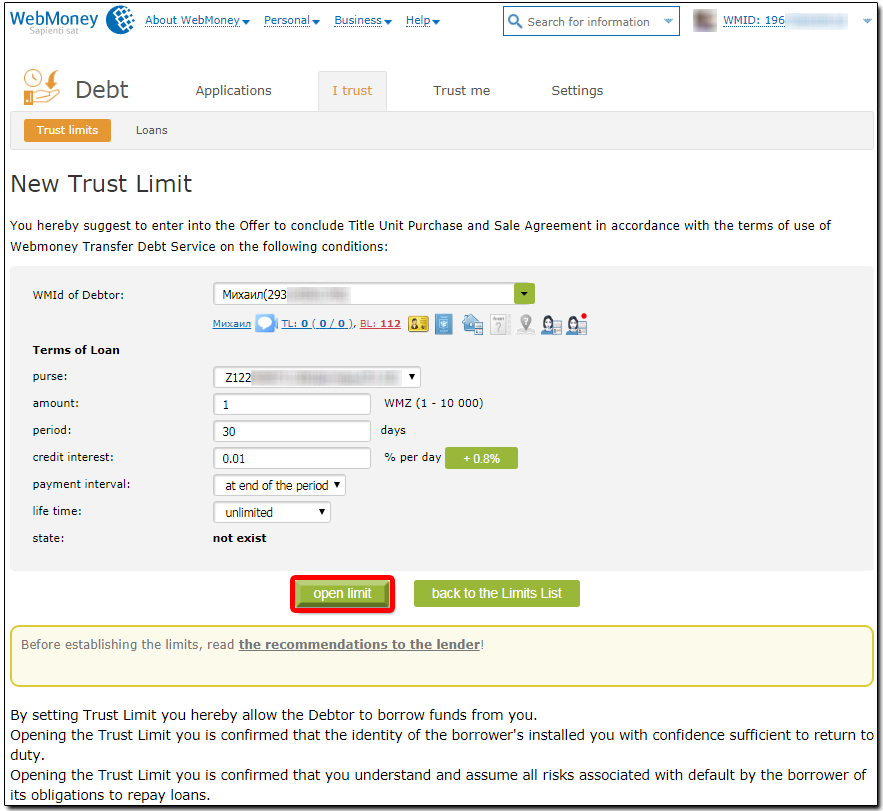

To open a TRUST LIMIT, select the purse from which the contact will be able to use funds, the maximum amount for the TRUST LIMIT,

the maximum payback term, and the interest rate charged. Fig. 1

Fig. 1 Form for establishing a TRUST LIMIT

After the TRUST LIMIT is saved, Debt Service sends the contact a message by WM mail, asking the contact to review and accept the terms of the TRUST LIMIT.

If the contact agrees, the contact can use funds under the opened TRUST LIMIT at any time, with the help of the service interface.

The TRUST LIMIT terms can be changed at any time by the owner.

Once changed, the new terms take effect only after they are accepted by the contact.

How to receive a loan through a TRUST LIMIT

To open the form for receiving a loan through an opened TRUST LIMIT, go to the «Contact properties» dialog and click the «Debt Service» tab.

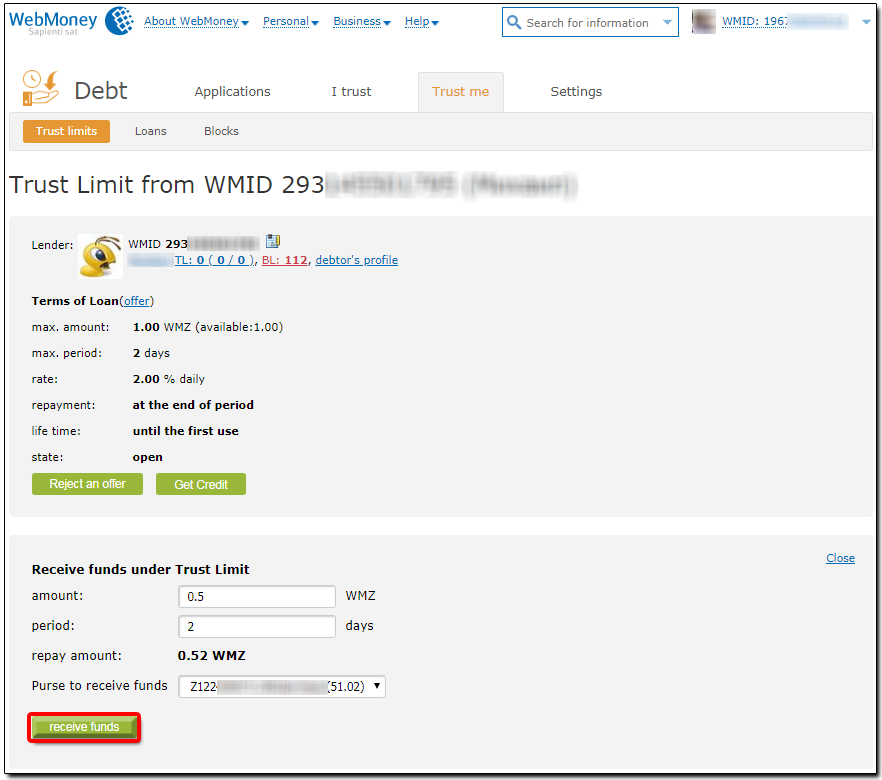

To receive a loan, select the purse, amount, and planned term of repayment. Fig. 2.

The amount and term cannot exceed the maximum values specified in the TRUST LIMIT.

Fig. 2 Form for receiving funds through a TRUST LIMIT

After determining the amount and duration of the loan, the contact must accept the agreement regarding the issuance of promissory notes and register these repayment notes at https://www.paymer.com.

The amount of repaid funds is calculated by the service based on the interest rate of the TRUST LIMIT, as well as the amount and term of the loan.

As funds received through the TRUST LIMIT are repaid, the promissory notes are automatically adjusted and eliminated.

If funds are not repaid on time, the promissory note is transferred to the owner of the WMID that opened the TRUST LIMIT.

How to repay a loan that you received through a TRUST LIMIT

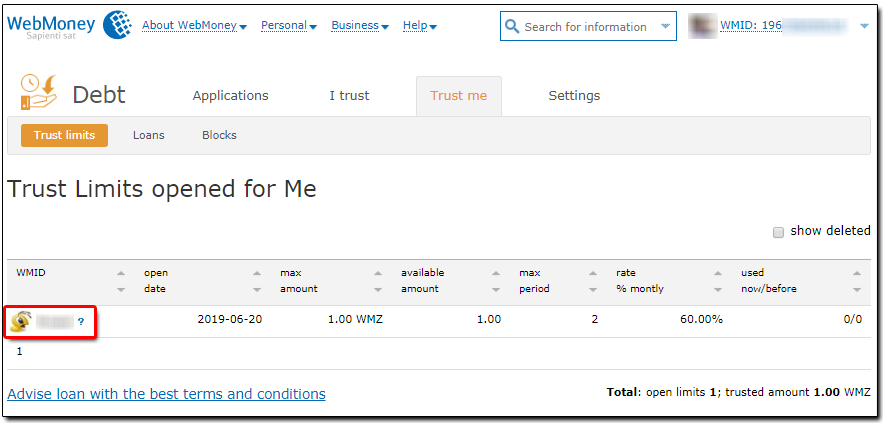

To view a form with a list of LIMITS through which you have received loans, in the «Personal Information» dialog,

in the «Debt Service» tab, click «Trust Limits opened for Me/details...» Fig.3.

Fig. 3 List of TRUST LIMITS

After you click the "details" link in the "used" column for the selected TRUST LIMIT, a list of loans for the selected TRUST LIMIT appears.

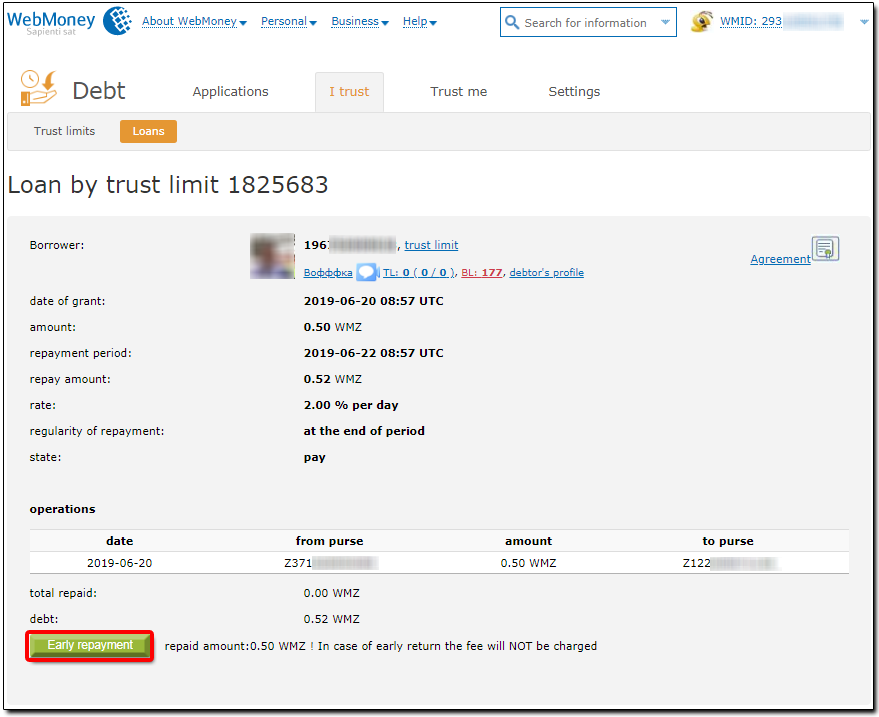

Left-click to view each entry in more detail (see Fig. 4).

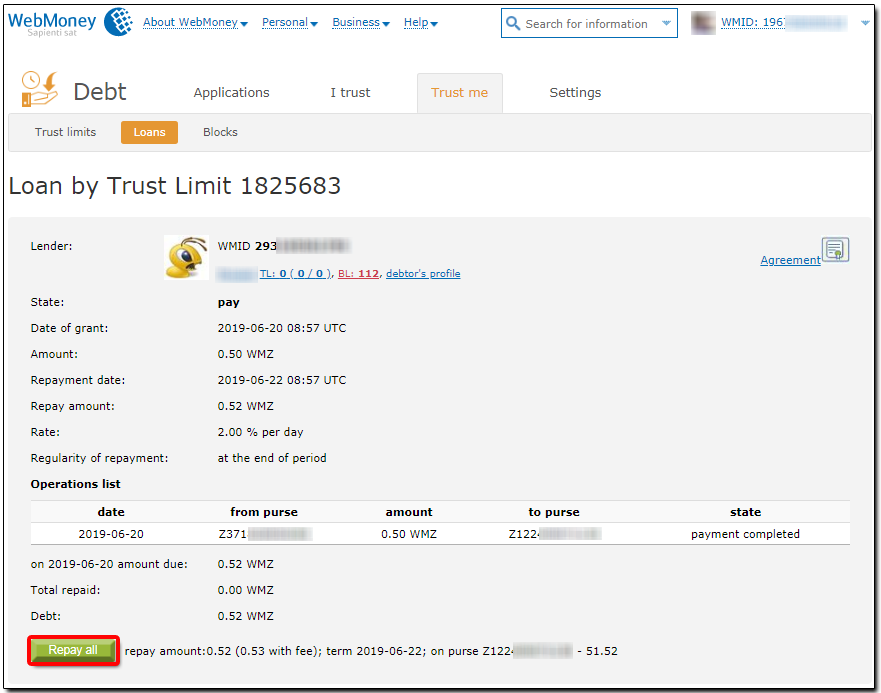

Fig. 4 Detailed information on use/repayment of funds received through a TRUST LIMIT

This form displays the terms on which you have used funds from the TRUST LIMIT; a transaction list (both receipts and repayments); amount currently owed, and the full amount to be repaid.

Depending on the repayment terms, both repayment of the current amount owed and repayment of the entire amount owed may be available.

For convenience, the form displays the current amount available on the purse from which repayment is to be performed.

For repayment, select «Next repay» or «Repay all».

Funds will be repaid only from the purse that received the funds originally.

IMPORTANT: Repayment of funds must take place through the Debt Service interfaces exclusively.

A direct transfer of WebMoney from your Keeper is NOT considered repayment of funds received through a TRUST LIMIT.

How to get back money that you have lent through a TRUST LIMIT

At any time, you can initiate repayment of funds that you have lent through a TRUST LIMIT by selecting «Next repay» or «Repay all».

If funds are repaid before the due date, the bonus for TRUST LIMIT use is lost.

The sum for repayment is deducted from the purse that received the funds originally.

If the balance on that purse is too small, funds will be deducted from other purses (beginning with the one with the largest balance).

If all purses combined lack the required amount, repayment will be performed through the TRUST LIMITS that have been opened for the borrower by other users

(beginning with the TRUST LIMIT with the lowest interest rate).

If the term for repayment expires, the Lender may freeze the Borrower's WMID until the loan is repaid.

If the funds available through open TRUST LIMITS are insufficient and the due date expires, then the promissory note for repayment of the outstanding amount

(registered on Paymer) may be transferred to you (as a Paymer check code and number) and become your property.

The debt is no longer tracked by Debt Service.

Fig. 5 Lender repayment form